The article was updated on February 06, 2023.

The personal finance app development segment has been growing steadily over the last decade, with lockdowns giving it an explainable boost. The need to keep track of earnings and spendings, and shopping online without having to visit a physical bank has made building personal finance apps a highly lucrative investment. From 2020 through 2021 the number of active users of money management solutions increased to almost 150% by some estimates.

If you are looking to invest into a personal finance app development, this article will give you an understanding of the current state of the market and provide you with some winning strategies for building a successful product.

What is a personal finance app?

Put simply, it is a piece of software that allows people to control their finances through an online interface or via a mobile device like a smartphone or a tablet.

People use money management apps for a number of purposes:

- monitoring spendings and earnings,

- saving money and staying on budget,

- regular balance checks,

- online transactions and payments,

- smart deposits and investments, and

- insights and advice about personal finances.

Personal finance apps like Mint have been around for less than a decade, however, they boast an impressive user base and are attracting new users willing to enjoy the obvious benefits:

- a comprehensive view of all their financial transactions,

- the ability to set financial goals and see them through to completion,

- easy budgeting and savings,

- an awareness of one’s financial behavior patterns, and

- learning the basic principles of personal money management.

Now that we’ve covered the benefits of these solutions, let’s look closely at the existing types of consumer-oriented money management software.

Types of personal finance apps

Most personal finance apps focus on one or several aspects of customers’ needs. Technologically speaking, these applications fall into two distinct categories: simple solutions with manual data entry, and software capable of automatically loading data and processing it to deliver insights.

Both application types have its pros and cons: while basic apps rely too much on the human factor (users may be too lazy to enter data), they are surely more secure and less expensive to develop compared to software connected to a bank account.

More specifically, the money management software includes the following types:

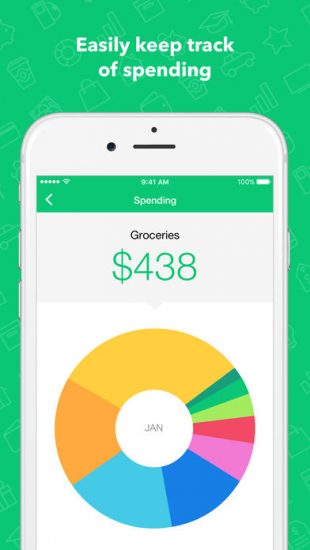

Spending tracker apps

This type of software for personal finance is aimed at taking control of one’s expenses and savings. Customers upload these apps to keep track of the money they spend on different occasions to become aware of their spending habits.

Finance tracker apps may require manual data input, or be tied to users’ digital banking accounts for automated tracking of their expenditures.

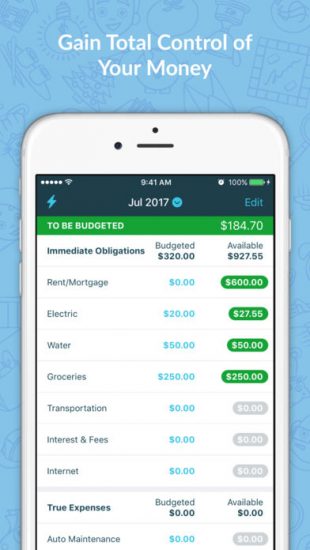

Budget planning solutions

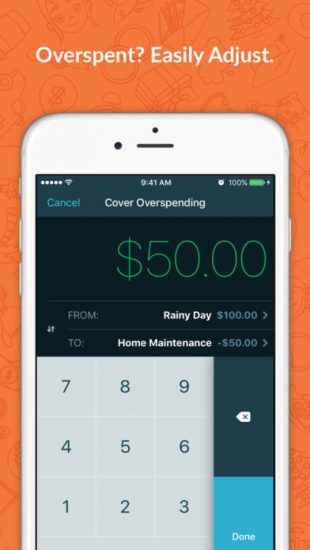

These solutions help customers set and achieve financial goals. A personal finance planner app will help individuals plan how much money they want to spend and save over a given period of time. The best budgeting apps will remind them to stick to their financial resolutions with alerts and notifications.

Read also: How to Develop an AI-Driven Budgeting App: A Comprehensive Guide

Investment apps

These apps enable people to put their money to work. Customers don’t have to be savvy financially to profit from using these apps – the best solutions are capable of making micro-investments and generating passive revenue. Peer-to-peer lending apps also fall into this category.

Top finance management apps

Answering the question of how to make personal finance is easy once you explore the specifics of the best personal finance apps like Mint and Mint alternatives.

Below is a list of top personal finance software that we believe to be attention-worthy.

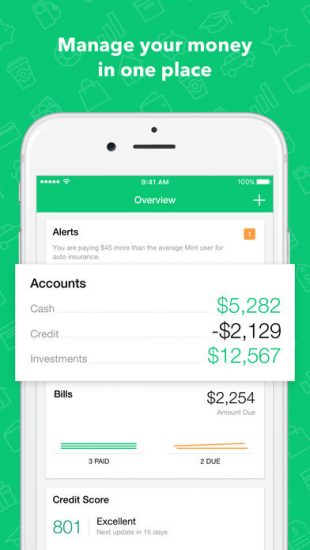

Mint

Mint is one of the best budgeting apps, combining budgeting with finance planning and bill tracking. The software also offers tips on savings and investments and allows users to calculate their credit scores. In addition, Mint alerts users about fraud or identity theft and enables them to take timely action.

Built by Intuit, Mint is one of the most trusted solutions on the market and is favored by millions of subscribers.

Pros: it is rich in functionality, and automatically aggregates data from users’ accounts free of charge.

Cons: it is unavailable outside the US and Canada, doesn’t support international currencies, and makes no distinction between a person’s budget and their income.

Cost and monetization model: Mint reaps revenue from referrals, direct ads, and selling data to third parties. The app has recently added a paid subscription option for users in the US, enabling them to receive in-person consultations from accountants and financial agents.

Several Mint alternatives to consider

Although the popularity of Mint is immense, there are some alternatives to Mint that are worth consideration.

Below are some examples of apps for personal finances that work in slightly different ways.

Wally

Wally is an app for tracking expenses, controlling savings, and helping customers achieve their financial goals. It is easy to use, offers a number of ways to monitor finances, and includes analytics and dashboards.

Pros: Has a great UI, security, and comprehensive data visualization allowing users to get a complete view of their finances and understand their financial habits.

Cons: Users have to enter data by hand, so it’s easy to forget or omit important data.

Cost and monetization model: Wally is a freemium app, which means that its basic features come free of charge. Upgrading to a premium version called Wally Gold will cost $35,99 annually, and $4,49 a month. The even more advanced version called Wally Gold Lifetime costs $47,99 annually, and a monthly fee is $4,99. Both versions offer customers exciting extra features, like the support of foreign currencies, joint wallets, and in-app purchases.

YNAB

You Need a Budget (YNAB) is one of the best mint alternatives, which is less simplistic. The solution offers more than just a set of money management tools and budget trackers: customers can also view educational videos on various aspects of personal finances to help them manage their money matters.

Pros: The software provides customers with unique budgeting techniques, automatically tracks expenses by pulling information from your accounts, and helps achieve financial goals.

Cons: It comes at a fee, includes no investment or bill tracking option, and falls short of delivering a holistic view of users’ finances.

Costs and monetization model: YNAB uses a subscription model and currently charges an $84 annual and $11,99 monthly fee.

Spendee

The standout feature of Spendee is collaborative budgeting. The app is capable of monitoring card balances of customers’ friends and family members, tracks shared budgets, and includes bill tracking capabilities.

Pros: The app is perfect for managing a joint budget of a household or a family, supports multiple currencies, and allows the creation of separate wallets for family members.

Cons: Its best features come in a Plus and Premium version, including pulling information from accounts.

Cost and monetization model: Spendee is a freemium app that charges fees for upgrading to an advanced version. The Plus plan comes at a monthly rate of $1,99 with a $14,99 annual fee. The Premium plan comes at a $2,99 monthly rate and a $22,99 annual fee, respectively.

Personal Capital

Another great example of a money management platform with comprehensive functionality. The software pulls and analyzes your account data, tracks cash flows, and ensures that you always stay on budget. However, unlike most of the apps similar to Mint, it focuses on investments. For premium users, Personal Capital offers live consultations with financial advisors on how to better manage their money and put it to work.

Pros: It combines tracking spendings with retirement planning and investments, offers personalized recommendations as well as financial portfolio analysis.

Cons: Expensive premium version. The service fees are high and subscribers with an account minimum of $100,000 are required to use its advanced version.

Costs and monetization model: the software charges service fees of 0.49% – 0.89% from its premium users.

Top features of personal finance apps

The answer to the question of how to build a personal finance app lies through understanding which features people are likely to expect from an app for personal finance planning before offering them something unique.

Below are some basic features that have now become a golden standard of consumer money management solutions.

- Registration/Login: the registration should be quick and easy, however, it is important to strike a reasonable balance between simplicity and security. Two-factor authentication and biometrics are now must-have features of personal finance apps.

- User profile: the profile should focus on the important information about the user, and is required for making the most of the application features.

- Integration with banking accounts: pulling data from users’ banking accounts for analysis. This feature is a necessity in money management apps like Mint.

- Tracking receipts and spendings: this feature shows the money received and spent on users’ accounts.

- Regular payments: this feature reminds customers about regular payments or enables them to make payments directly from the app.

- Debt: this feature helps users keep track of their debt, and tweak their spendings accordingly.

- Cashbacks and bonuses: this feature aggregates the information about extra bonuses available to customers and notifies them about cashback available for their purchases.

- Investment and savings: the best apps for money management suggest investment and savings opportunities for clients.

- Reporting and analytics: people expect their personal finance software to be equipped with data analytics modules, helping them monitor their spending habits and offer insights into the state of their financial affairs.

Additional features

Additionally, there are some app features that may give your app a competitive edge:

Cryptocurrencies integration

The best finance apps offer cryptocurrency integration and enable customers to manage their crypto-balances. Some apps focus exclusively on cryptocurrencies and trading, so you may consider enhancing your solution with similar features.

Assistance and support

Sooner or later, your app users might encounter problems or become confused about a certain financial matter. The best personal finance management apps feature 24/7 support. You may also want to consider building a chatbot that is ready to answer customers’ questions.

Gamification

Customers also expect their solution to offer them exciting experiences and engage them in meaningful interactions. Wally, for example, allows users to earn Coins by sharing the app with their friends. The Coins are valid for a year.

Personalized financial consulting

Managing finance can be complex. People expect their personal finance apps to do the tricky analytics part for them: the apps should be capable of analyzing customers’ data and choosing the best financial products, retirement plans, investment areas, etc.

We at Eastern Peak are here to help you build a Mint alternative and make your app for personal finance successful on the market. Need to develop a personal finance tracking app?

Non-functional requirements for personal finance apps

Apart from the mandatory features, personal finance software apps should also meet the following performance criteria:

1. Security

Finance apps should comply with security regulations and standards. PCI DSS regulation, for example, obliges developers to comply with twelve rules to ensure credit card security. These rules cover passwords, firewalls, data transmission, authentication, and risk assessment.

2. Compliance with Open Banking best practices

Open Banking is an international standard enabling the safe exchange of financial data. Open Banking principles put security and data protection first. Most apps for personal finance management are capable of pulling data from users’ accounts, however, customers should be able to restrict this feature to protect their data.

3. UI/UX

The finance app should have excellent navigation and usability. The idea is that users already dealing with complex money issues shouldn’t be put off by the complexity of the user experience. A seamless UX is a keynote of your app’s success.

4. Clear reporting

Reporting features are what customers love most about personal finance solutions. The data in this report, however, should be presented in clear and simple formats, and be easy to use for financial insights and growth.

Monetization models of personal finance apps

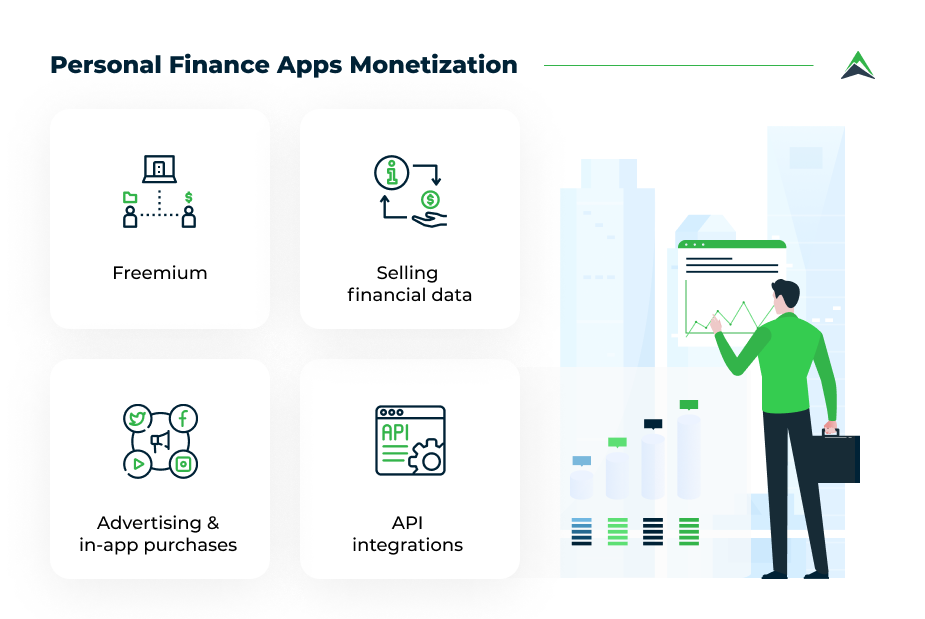

So how do personal finance apps make money? Most apps that we have listed in our overview are using a Freemium strategy: they offer certain features for free, while a more advanced feature set comes at annual and monthly fees. In addition, these solutions are also reaping revenue from the following:

Advertising and in-app purchases – offering users financial products from partners such as consulting, insurance, deposits, or loans. The app will need in-built payment gateways for making purchases.

API integrations – if you build finance software, you can make additional money from offering paid access to its APIs to third parties. For example, Currencylayer’s API provides users with info about currency conversion rates across the world.

Selling financial data – provided that it is anonymous, this revenue model is completely legal. Money management apps like Mint collect and process and sell data on consumer behavior, spendings, income, and savings to companies and enterprises. Such data is in huge demand, so selling it is a viable means of earning money with your software product.

How to develop a personal finance app like Mint?

No matter how good Mint or any of its alternatives might be, creating a 100% clone of an existing app is never a good idea. After all, why would a user give up on an app just to switch to an identical one?

So if you want to build a product that users will actually want to use, then you should create a unique and appealing value proposition. Consider all the benefits and drawbacks different Mint alternatives provide and try to create something better.

See our Fintech portfolio

Based on the highlighted drawbacks and feedback from real users, we have created a list of tips and strategies which you should take into consideration when creating a personal finance app.

- Always leave room for customization. Automated expenses tracking is highly appreciated by users. However, some users might not want to give a third-party app access to their banking accounts. In this situation you should consider the option for manual data input. Even with automated expense tracking, provide an option to edit or customize the data.

- Prioritize UX. It is easy to get lost in financial data, and that is why the user experience is important for a successful finance management app. Make sure your product’s UI is clean and uncluttered, reports and data are easy to understand, and the flow is intuitive.

- Invest in customer support. Money is one aspect of our life that we need to be dead serious about. Thus, 24/7 online support is crucial for any finance management app.

- Keep your users in the loop. Push notifications and alerts on upcoming payments are a valuable feature for personal finance management apps like Mint. Make sure the reminders are timely and non-intrusive. You can also consider other push notifications scenarios, for example, notifying your users when their goals are met, or reminding them to stay on budget.

- Focus on convenience and mobility. For example, Apple Watch support offers convenient payment options and allows its user to always have their crucial finance data at hand (literally). Custom widgets offer a convenient way for a user to input data or to keep track of their current balance.

- Capitalize on hidden market opportunities. Most of the apps that we have considered lack family sharing options. Being able to create joint bank accounts or track all family finances within one app might be a good selling point.

- Make security your top priority. Use additional security layers (encryption) and advanced authentication methods (Touch ID, two-factor authentication, or even iris scanning) to guarantee the safety of user information.

- Consider different monetization options. People don’t like ads. Using banner ads in a finance app makes it look spammy and insecure. Thus, a freemium strategy (with a free basic plan and additional paid features) would be a more suitable option for these kinds of apps. Alternatively, you can use a referral strategy, i.e., a partner with related businesses to monetize your product.

- Keep users in sync. Real-time synchronization (between devices as well as with bank accounts) is one of the most quoted features most Mint alternatives lack. Thus, providing real-time data synchronization in the background might be a good selling point for a new app.

- Choose a niche audience. Most of the products that we have analyzed are aimed primarily at US consumers. Targeting less saturated local or emerging markets will give you a lower barrier for entry and better chances for success (although, you should be ready to fight some additional regulation hurdles). Alternatively, you can target a small niche audience within the developed markets (freelancers, students, families, or seniors).

The listed strategies work well only if used wisely. With apps like Mint it is easy to get carried away and overcrowd your app with unnecessary or excessive functionality.

Always remember to stay lean. This might come in handy when you decide to pivot. Moreover, some of the secondary features might be left unnoticed or unwanted by your users, so the invested time and money will be wasted in the long run.

Our work case for financial institutions

A mobile application where users can save money, lend and borrow to/from fellow application users, find people to trade with, create groups and manage their motshelo accounts (deposit, withdraw and transfer).

With Motshelo Mobile users also can:

- Get access to cash through VISA Card and all major retail shops

- Generate summary reports on all transactions

- Track individual savings, trades, group’s financial status

Wrapping up

The personal finance app industry is currently showing an impressive growth rate, triggered by the pandemic crisis and the growing number of smartphone users, competition from personal banking apps, and a budding market for embedded finance. According to Allied Markets Research, in 2019 the market for financial apps was valued at $1,024.35 million and is predicted to reach $1,576.86 million by 2027.

That is why right now might be a good time to invest in personal finance app development. Having worked with global financial companies such as Western Union, we at Eastern Peak know how to develop personal finance apps that users will love.

How to get started?

The product discovery phase is the best first step you can take to lay a solid foundation for the development of your app. It includes a functional specification, UX/UI design, and a visual prototype that will give you a clear vision of the end product. On average, this phase takes 4-6 weeks.

The product discovery phase can help you:

- define a full scope of work and develop a roadmap for the project

- set a realistic budget for your MVP and plan your resources

- test the waters with your audience using a visual prototype

- craft a convincing investment pitch

- get to know your team

Have a finance app idea in mind, but don’t know where to start? Feel free to contact us, top Europe’s app developers and book a free consultation with our senior PM!

Read also: