The article was updated on July 03, 2024.

Fintech is a field where cutting-edge innovations can be a deciding factor in the success of any promising startup. Artificial Intelligence and IoT, in particular, hold the top spot among the technologies that can propel your business forward and revolutionize financial services as a whole.

Mordor Intelligence estimates the global market of AI in fintech to hit $44.08 billion by the end of 2024. This number is only projected to grow at a CAGR of 2.91% over the period of the following five years.

The surge in demand for integrating AI can be easily traced to its key benefits in the scope of fintech solutions: it can streamline customer service by introducing chatbots, significantly improve fraud detection rates, and implement virtual advisors to manage billions worth of assets worldwide.

At the same time, the Internet of Things in financial services can boost customer experience by introducing smart ATMs, upgrading the efficiency of transactions with traditional wearable devices, and even producing connected jewelry. By 2031, the global IoT in fintech is expected to reach $15.04 billion.

If you’re looking to build a fintech startup, this article is going to shed some light on how to harness the power of AI and IoT to get ahead of the competition. We’ll review promising fintech AI use cases and uncover how to implement the most sought-after features IoT and AI have to offer.

The internet of finance: How fintech companies can benefit from IoT

The primary benefit of fintech and IoT integration lies within the additional data channel it opens. By using smart connected devices, fintech companies can better understand customer behavior and tailor their product offerings accordingly.

Moreover, integrating fintech and IoT (i.e., personal wearable devices) will potentially make payments easier and safer.

The following will outline the most significant benefits obtained from the use of fintech IoT:

Wireless payments

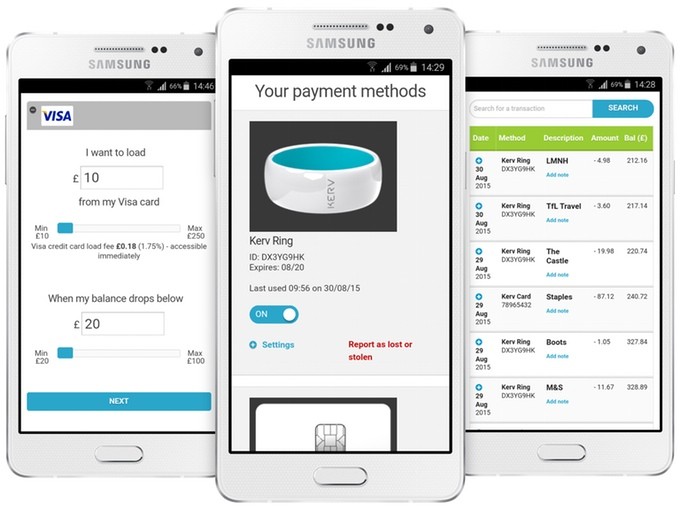

Wearables have the potential to transform cash withdrawal and wireless payments by replacing traditional cards or smartphones with smart devices. In addition to popular smartwatches, there are several startups working on smart jewelry. Namely, Kerv positions itself as “the world’s first contactless payment ring.”

Security & authentication

Another use case for wearable IoT in fintech is security. For example, Nymi is a smart wristband that uses the person’s heartbeat (electrocardiogram) as the biometric authentication key. The technology was also tested for secure wireless payments back in 2015.

Risk assessment for insurance

Various IoT sensors can be an invaluable source of data for the insurance and risk management sectors. For example, car insurers will be able to offer personalized insurance packages, based on the client’s driving behavior, average speed, time and distance traveled, etc.

A good example of usage-based insurance is represented by Sierra Wireless.

Another car insurance startup, Metromile, offers a similar approach with its pay-per-mile insurance plans. Your vehicle can send any information directly to the insurance company to help document an accident or speed up the insurance payment.

A similar approach can be applied to smart home devices or health IoT devices, such as fitness trackers. Insurance companies will collect information about house maintenance or the condition of your health and tailor the insurance terms accordingly, or reward you for positive behavior.

For example, Beam Dental offers personalized dental insurance plans, based on the data sourced by their smart toothbrush.

On-site customer experience

Beacons can also improve the on-site banking experience with contextual information delivered straight to your iPhone (similar to the way retailers use IoT devices). This creates opportunities for personalized, tailored in-branch experiences.

By using such devices, bankers will be able to streamline their customer service and automate routine tasks. For example, they can send their customers to address the right specialist, depending on their questions, or help them navigate inside the bank.

Furthermore, NFC beacons can also be used to facilitate the checkout process and make payments easier.

Smart ATMs

Another fintech IoT phenomenon is smart ATMs. In addition to the regular services ATMs provide, these enable users to deposit funds, open bank accounts, and change a card’s PIN, to name a few. They’re already in use by Marine Credit Union, Seacoast Bank, and numerous others.

Smart ATMs partially remove the necessity to visit a local bank branch, which, in turn, makes organizations that use them more attractive to consumers. Also, this example of fintech and IoT integration serves to boost the safety of such operations by packing smart ATMs with sensors to prevent physical and virtual threats.

How AI is changing fintech: The advantages and use cases for artificial intelligence in finance

The amounts of data sourced by applications as well as integrated fintech IoT devices can serve as a key enabler for better, smarter financial management. Furthermore, fintech AI use cases are virtually endless.

Feeding the users’ data to advanced machine learning (ML) systems can help you train the algorithms to optimize and automate many routine tasks. Thus, the processes that were once extremely resource-consuming will now become fully streamlined and more efficient.

Plus, unbiased, data-backed AI algorithms will eliminate the possibility of human error and minimize the overall risks in the sector.

The application of artificial intelligence in finance spreads across many areas, from personal banking to investment, asset management, and insurance.

Here are some examples of artificial intelligence in banking and finance:

Chatbots

There are several use cases for chatbots and AI in fintech:

- personal finance management and tailored financial recommendations (e.g., Penny – acquired by Credit Karma)

- budgeting and expense tracking (e.g., Olivia)

- savings (e.g., Digit)

- micro-investments (e.g. Plum)

- mobile payments and P2P money transfers (e.g., MyKAI)

Another widespread use case for AI in fintech, and specifically with chatbots, is customer service. By using smart AI agents, companies can speed up their response times and improve their issue resolutions rate. This has the potential to increase customer satisfaction and help brands increase loyalty.

Preventive cybersecurity and risk analysis

AI in the fintech industry can be used to identify and prevent various cybersecurity threats. Moreover, machine learning algorithms can conduct an unbiased risk assessment and detect suspicious behavior or transactions.

Read also: How to Prevent Financial Fraud with Machine Learning

Automated investment and asset management

Among the sectors that can benefit from smart automation, investment and asset management represent one of the most significant opportunities within the finance industry.

AI fintech startups can leverage big data analysis and enhanced risk management, as well as utilize AI’s predictive qualities to guide investment choices. The options are so limitless that AI in asset management is predicted to grow from its 2023 market value of $2.78 billion to $47.58 billion by 2030.

Some of the most popular AI fintech startups in this sphere are Wealthfront and Betterment.

Data collection and analysis

One of the examples of artificial intelligence in banking and finance is data analysis systems. The fintech sector deals with astronomical volumes of information, and it can quickly eat up a company’s budget to process it by hand.

AI grants fintech organizations the ability to automate data analysis, pattern detection, and, in some cases, even decision-making. In terms of predictive analytics, it can also yield more accurate market forecasts.

Regulatory compliance

Another use of AI in fintech is streamlining regulatory processes. Companies in this sector face an abundance of regulations to comply with, and, considering continuous updates, it can be a struggle to navigate the modern law.

AI-powered services, such as RegLLM, can help with that by providing context-aware responses to regulatory questions. They can be fine-tuned to a particular company’s needs and easily integrated into the existing ecosystem.

Things to consider when building a fintech app with AI or IoT integration

We’ve discussed the benefits of integrating fintech and IoT and how AI is changing fintech, so now it’s time to review a couple of details about their implementation.

When designing any app, the process involves researching your target audience, prototyping, and completing other regular development stages. With finance and IoT, however, you may find quite a few additional requirements, such as security and device integration.

In this section, we’ve outlined several points to pay special attention to when developing AI applications in fintech.

1. Get to know your market

When targeting a highly competitive industry, such as fintech, start with understanding the current market state and customer demand. What are the existing solutions? Which problems do they solve? Are they popular?

You need to know the competition in order to find a unique benefit that can set you apart from the rest of the market players.

Get to know your target audience – run a survey or create focus groups to talk to your potential users in person. Thus you will be able to identify the needs of your audience and understand if you can satisfy them with your product and how exactly you can do that. You can also learn from the success and failures of your direct and indirect competitors.

2. Pay attention to security

The applications that deal with user data, especially a financial one, must provide the highest level of protection.

Taking into account the amounts of information that IoT devices collect and the data that is needed to build and train AI algorithms, security should be your number one concern. Specifically, there are some major security risks when using automotive IoT devices or smart home devices.

With the introduction of the new data protection regulation in the EU, you should know exactly what data you collect, where it is stored and how it is used. Make sure you are aware of the possible legal implications and put the required security practices in place to avoid penalties.

3. Always think user-first

Most financial products, especially the ones that include IoT integrations and complex AI-based features, are usually hard to set up and use. It can be challenging for the users to understand how it works, which may breed confusion and low customer retention rate.

From your website to the app itself, make it easy to grasp the benefits of your product. Create a comprehensive onboarding UX to help users get started with your products. Your app should be easy to use and navigate. Include a detailed FAQ page or a 24/7 in-app support line.

4. Build an engaging experience

Personalization is another key element of a successful financial app. Having access to loads of customer-specific and real-time behavior data allows you to tailor the experience accordingly.

For example, you can push customized offers to your users depending on their activity. This can be a one-time discount for a purchase at a store you’ve partnered with, bonuses for specific actions within the app (e.g., inviting a friend or rating the app), cashback on every second purchase with a wireless payment.

5. Don’t overcrowd your app with irrelevant features

Keeping a financial app lean can be a challenge, especially if you are building a personal finance app. Yet, it is essential to keep the less important features to a minimum, at least at the beginning.

Building an MVP to test out your assumptions and improve/change/expand/pivot it in the future is a smart strategy that can save your time and money.

6. Integration with existing systems

When integrating fintech and IoT, it’s crucial to consider early on how your app will fit into a larger ecosystem and work with other third-party services.

One part of that is deciding what devices the app needs to integrate with and how you can secure the efficient exchange of information among all of them. Talking about AI in the fintech industry, you also need to consider how its implementation can affect other processes and software.

For instance, when you add a chatbot to your site, customer inquiries may be processed through a different mechanism than if there’s a human support specialist documenting the issue.

Additionally, if you’re planning on developing a B2B app that helps companies inject artificial intelligence in financial services, it’s vital to determine how your application is going to integrate with your client’s existing software, services, and practices.

Build the future of finance with Eastern Peak

One more critical element of a successful fintech app is having a strong team by your side. In this case, it’s important to find a technology provider that has deep domain experience in fintech as well as extensive technical expertise in IoT and AI. This is precisely what we offer at Eastern Peak.

We have a solid fintech portfolio, and also specialize in building custom IoT solutions – from concept to hardware design and software integration. Hire a dedicated team to build your product on time and on budget. For an estimate or professional consultation, get in touch using our contact form.

Read also: