A book shouldn’t be judged by its cover, but a FinTech app is quite another thing. With such an oversaturated market, offering an app that simply “does the job” is not enough. Making it stand out is hardly possible without a seamless and engaging user experience. Here’s where the key principles and trends of FinTech app designing can make a crucial difference.

The global FinTech market value is projected to soar to $492.81B by 2028. Around 5.62B users worldwide have adopted FinTech solutions as of 2023. Such mind-blowing numbers mean that more and more businesses will be actively entering the domain. As an example, over 26,000 FinTech startups had been registered globally as of 2021. While the industry is booming, users are growing pickier with whom they would entrust their finances.

A smartly designed banking app that is simple and enjoyable is the present – and the future of FinTech. The majority of Gen Z and Y already rely on mobile banking. Accustomed to the intuitive design of social media apps, they will expect the same from the financial sector. Following the latest trends in FinTech UX design is vital to satisfying these modern demands.

Let’s have a closer look at these trends and their impact on the financial app design process when creating your own FinTech product.

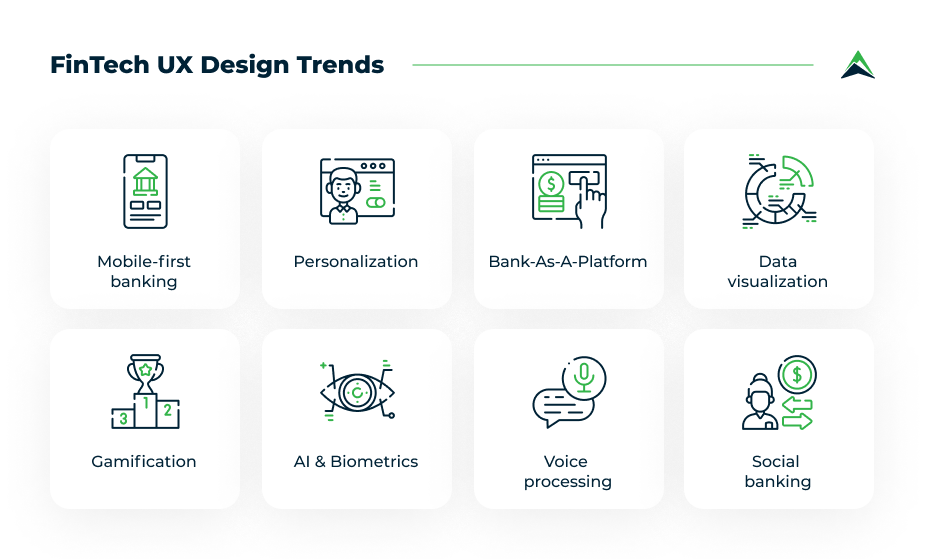

FinTech UX trends

UX design in the financial sector is aimed at simplifying user interaction with the app. While some fund management tasks are fairly simple, others may require more effort. To minimize the latter, mobile banking app designers employ a number of UX principles and techniques. This, in turn, makes the apps more user-centric, engaging, and secure.

Let’s cover the latest UX design trends for such apps:

1. Mobile-first banking

Classic banks deliver their services either in person or through an online platform. Modern FinTech products aim at providing financial services anywhere – and anytime. They are easily accessible and don’t require customers to pay a visit to a local branch. As more and more industries are going online, banking definitely doesn’t fall behind.

Eliminating the need for brick-and-mortar institutions is only one of the advantages of the mobile-first approach. Mobile banking apps have lower entry barriers, giving their clients more financial freedom. Many of them strive to increase users’ financial literacy, rewarding the right behaviors. What’s more, FinTech apps are generally more intuitive and easier to navigate than the online banking platforms.

Such banking apps as Revolut have put user experience high on their priority list. A comprehensible interface, transaction monitoring, and budgeting features had attracted 20M users as of June 2022.

2. Personalization

Mobile app users’ demands are growing day by day, and the financial industry is no exception. The top successful applications adapt to user experience, offering personalized and customized solutions. From tweakable interfaces to exclusive financial advice, FinTech apps are actively competing for their clients’ business.

Personalized financial services do wonders in boosting user engagement and brand loyalty. Managing one’s funds can be a very mundane and routine task – unless an app can offer more. Budgeting tools such as tracking personal expenses or making savings, easily win over clients. Other individual solutions may include targeted product recommendations, offers, and loans.

One example of successful personalization is Subaio, a FinTech startup. It allows the Premium customers to analyze, manage, and cancel their subscriptions without leaving the app. The company has also partnered up with the Dutch bank ABN Amro for personalized loan offers.

3. Bank-as-a-platform

BaaP approach involves giving access to the core banking functionalities to third-party developers and financial service providers. Such a “platform” can be built upon and used for delivering one’s own products and services in FinTech.

The main advantage of BaaP lies in the integrated experiences for users. Payments, investments, and insurance become available within a unified interface. This, in turn, calls for more adaptable UX solutions (modular design, personalized interfaces, data visualization, and more). Ultimately, users should be able to seamlessly experience a wide range of financial services and products.

For instance, the Spanish bank BBVA has opened its platform to third-party developers. The latter can build apps that access various banking services via a set of APIs. As a result, these apps provide a smooth and natural user experience.

4. Data visualization

FinTech app users can easily get lost in all the numbers that are thrown at them. Tracking and categorizing expenses can be painful without a clear and concise visual representation. For this reason, data visualization is almost a “must” in the FinTech app design.

A great example of visualization in FinTech is PocketGuard, a budgeting app. It can display the expense data in different ways: as a user-friendly pie chart or a list. The spending history can be presented in the form of bar charts for easier comparison. No wonder that it is trusted by more than 1M users.

The most advanced financial services products take this trend even further. The use of AI allows them to visualize the possible outcome based on customers’ choices. In other words, app users can plan their budgeting in a simple and user-centric way.

5. Gamification and behavioral banking

How do you turn repetitive fund management tasks into something better? Gamification is the key to fresher and more rewarding user experiences in banking products. Its core principles such as engaging, encouraging, and rewarding positive behaviors, make banking fun, thus boosting brand loyalty.

Gamification techniques in FinTech include point and badge, level and leaderboard systems. Virtual assistants and interactive tutorials also make the list of gamified solutions for such apps.

Monobank, a popular Ukrainian neobank, has devised a mascot-based achievement system for rewarding users. Spending money on certain categories, making transactions abroad, or bill splitting earns achievement badges for users.

As for behavioral banking, it comprises personal insights, recommendations, alerts, and more. These offerings draw on psychology and cognitive science data to help users convert their goals into actions. In terms of a FinTech app’s UI design, this means more simplicity – and more engagement for the clients.

Read also: Gamification in Banking: Best Practices to Drive Customer Engagement

6. Artificial intelligence

Speaking of AI, more and more banking apps are currently jumping on board. Not only can AI help with financial education, but it can also serve as an advisor. Instead of hiring a professional, users can get practical tips without even leaving the app.

The other areas where AI can make a difference are data management and transaction security. The former relies on streamlining and automating data retrieval from various sources (databases, user interactions, etc.). The latter embraces fraud detection in real time, phishing detection, risk profiling, and much more.

Kount, a fraud prevention platform, has been a notable success in AI-supported security. By analyzing billions of transactions across industries, it can assess the risks with many variables. Geolocation, device type, frequency of transactions, and a lot more factors help detect fraudulent activity.

Discover our fintech solutions portfolio!

Having built lots of successful fintech products for industry leaders like Western Union and startups worldwide, we can help your fintech business utilize new technologies and grow in the finance industry.

7. Biometric technologies

Another way to boost a financial app’s security is utilizing biometrics. Yes, it’s all about the face, voice, and fingertips – but modern tech has gone beyond that. In today’s FinTech apps, identification is possible even through specific and unique behavioral patterns.

Naturally, biometrics is much more secure than relying on a password. Users can safeguard the access to their account by logging in via a TouchID or FaceID. High-sensitivity functions, such as setting limits, can be reinforced by additional authentication. As for behavioral recognition, it can rely on typing dynamics, touch/swipe patterns, navigation, and more. This, in turn, reduces fraud and false positives, while being more private than traditional biometrics.

Monzo, a UK-based neobank, has become highly secure by utilizing biometrics in various scenarios. Fingerprint and face IDs are used for accessing the app; certain transactions and card management actions also require biometrics. This not only makes online banking more secure, but also offers a smoother financial services’ UX.

8. Voice processing

This modern technology is actively transforming FinTech apps. Voice-enabled banking covers not only VoiceID verification, but regular activities as well. Transferring money, checking one’s balance, and other actions can be performed via an AI voice assistant service. The clients will then be able to manage their funds just as they manage the appliances in their smart home.

From the design standpoint, voice assistants can make a FinTech app’s UX significantly better. A single microphone icon provides access to voice requests, which the app fulfills. Instead of typing – or tapping, users will only need to confirm one of the AI suggestions. This will save a lot of time and effort, making online banking much more streamlined.

Capital One, an American financial corporation, integrated some of its services with Amazon’s Alexa. Transaction activation, financial queries, security matters, and other services could be carried out via a voice request. Capital One has received a lot of positive user feedback upon implementation, highlighting the service’s convenience.

9. Social banking

Where the banking of yesterday was rather strict, modern FinTech grants more liberties to users. Couples can now manage their funds together, and friends can share a bill at a local restaurant. Moreover, the interface of such solutions is rather similar to the familiar social media feed.

Why is social banking in demand? In today’s world, where connections are moving online, such banking user experience nurtures human relationships. Friends or partners can interact financially as if on social media – and keep their close ties.

One example of social banking in FinTech is WeChat Pay, a part of the WeChat ecosystem. It includes social media integration, P2P payments, group and other interactive features. WeChat Pay has become an indelible element of hundreds of millions of users’ daily life.

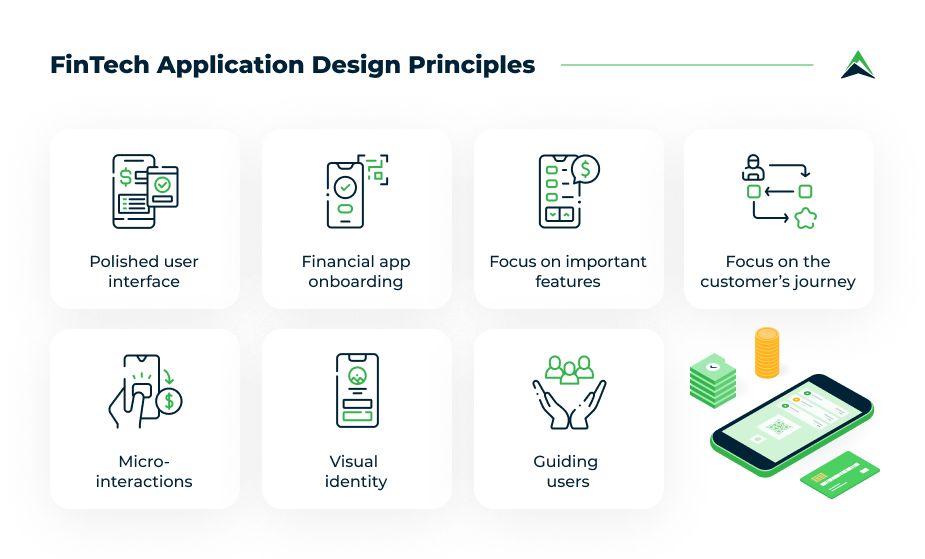

FinTech app design principles

FinTech app user engagement is vital for client retention. To implement the latest UX trends in the finance industry, developers must follow a number of core principles.

The overall concept is to make the client’s journey as smooth and simple as possible. User-centric and uncluttered UI, micro-interactions, and good visualization are crucial in this case.

1. Polished user interface (UI)

A confusing, cluttered interface is a major “no” in terms of mobile banking trends. Even if such an app offers unique and highly useful services, users may still get turned off. Nobody wants their online banking to be slow and tedious, especially with so much competition around.

An ideal UI design for a financial app is client-friendly, streamlined, and visually pleasing. Clients should be able to navigate the app intuitively – and without getting lost. However, a good app needs more than that: it must be visually appealing and reflect the brand identity.

This helps build a better connection with the app as a digital solution. Visual design elements, imagery, color palette, and fonts shape up the overall perception of the application.

2. Financial app onboarding/authentication

Onboarding is important for introducing clients to a FinTech app and its functionality. Some of them might remember the long and tedious process of opening a bank account. The goal of a financial app is to cover said process in minimal steps.

The other factor to consider when designing an app is user’s safety and security. The banking industry must comply with the KYC/AML regulations, so a certain identity check is required. One popular way to achieve this is to request a picture of a new user’s ID. Some apps ask users to take a selfie with their ID for added safety. However, basic account opening should be as quick as possible to showcase the app’s benefits.

3. Highlighting the most important features

When a client installs a FinTech app, they typically want to start right off the bat. The core features that enable fund management or money transfer must be readily available. When such features are prominently displayed, users are able to complete their tasks in less time. Too many features thrown at them at once could be overwhelming, in contrast.

When building a FinTech app, it is important to prioritize the features by ranking them. Fine-tuning the interface and making navigation accessible (bottom bars, tabs and menus) is also helpful. Taps should be minimal, and the icons consistent. This will help the client find the necessary features without delay. The app design must be adaptive and responsive as a whole to satisfy the user’s requirements.

4. Focusing on the customer’s journey

A financial app might have all the “trendy” features – and yet not be attractive. If the user flow is too drawn-out or complex, such an app might not inspire loyal customers. Hence, the designers must work to reduce the number of steps taken to perform an action. With that in mind, one mustn’t compromise on security, especially in case of money transfers.

Another important element here is personalization. A good mobile banking app delivers a tailored experience to its users by catering to their unique needs. Including simple questions or polls during onboarding can help achieve this goal. Instead of throwing everything at everyone, FinTech app development should concentrate on individual preferences first.

5. Micro-interactions

Users might want to swap financial apps due to the small but annoying UX gaps. For instance, not showing the loading screens may be confusing and irritating to some. A well-designed app mustn’t leave users guessing as to what is happening at the moment. That is why adding subtle motion graphics is always a nice idea for a FinTech app.

Such graphics do wonders for displaying statuses and keeping users in the know. Besides, if done creatively, it sets the app apart from the direct competitors. A loading screen or bar can feature the brand’s mascot or unique visuals to stand out. It will also make the waiting times less disruptive for the users.

Read also: Microinteractions: Building Meaningful Connections With Users Through Design

6. Visual identity

Fresh, distinctive design elements are an absolute must for a successful banking app. Boring and basic traditional banking applications don’t cut it anymore, becoming obsolete. The new solutions should be singular and user-centric in their visual appeal.

Brand representation plays a pivotal role in designing a financial app. The color palette, imagery, and fonts must be aligned with the brand identity. Moreover, they should convey the correct message to the client. Being original is fine, so long as it doesn’t hamper the app’s usability. A warm and welcoming design is much better than an overly bright and bold one. A bit of playfulness, however, is not a bad thing at all.

7. Guiding users

A modern FinTech app should be easy to navigate for an average client. Since it involves sensitive financial transactions, it mustn’t be too complex to not induce anxiety or confusion.

Achieving this goal from the design standpoint is possible through intuitive navigation and understandable CTAs. Clear feedback after performing an action allows users to feel more confident. If an error occurs, it is important to suggest a way to correct it. These simple yet effective techniques make using a banking app a pleasure rather than a chore.

Explore custom design services with Eastern Peak

Having vast experience creating custom design solutions for fintech mobile and web projects, we at Eastern Peak know how to set you apart from the other finance apps on the market and drive user attention.

How it works: Steps to FinTech app designing

UI/UX design is a complex process that consists of several steps. It involves pinpointing the target customer, comprehensive planning and prototyping, and gathering feedback. Each step is an integral component of the app’s future success with the customers.

Let’s look at how the FinTech UI/UX app design is carried out in more detail:

- Knowing the target market. Prospective users’ needs and goals shape up the design conception for an app. Identifying the target persona and creating the mood board is required for making a conscious effort. This initial step lays the foundation for the project and should not be omitted.

- Developing wireframes. Based on the target persona and the mood board, the developers start with practical planning. The main focus during this stage is on the product’s utility, features, and structure. The end goal is to design a simple visual representation of the interface.

- UI design. Next up, the basic wireframes are filled with hi-res visual elements to complete the impression. The banking app will acquire its full look at this point for more detailed suggestions or improvements. It is here that the designers can realize their full creative potential.

- Interactive prototyping. At this point, the approved app designs become real-life prototypes. The interactive elements are added to the visuals, completing the prospective user’s experience. UI/UX design, navigation, and user flow, as well as transitions and micro-actions, are added to the layout.

- Collecting feedback. Beta tests with the target market are a great way to collect authentic feedback. This way, the developers can be sure that their FinTech app is as user-centric as required. If any final changes are required after that, they are implemented before deployment.

In conclusion: How to design a fintech app

Modern FinTech apps rely on a simple, client-centric UI to get ahead of the competition. This helps ensure a seamless interaction with such apps. Unlike the often bland and user-unfriendly traditional banking solutions, the new ones are much more “humanized”. With the right app design, managing one’s funds online will not feel boring, repetitive, or overcomplicated.

Some of the top FinTech UX design trends of today include the following:

- Mobile-first banking,

- Personalization,

- Gamification,

- AI and biometrics, and

- Social banking.

How to design a FinTech app that is successful and competitive? The app’s design must be polished to perfection, highlighting the most important features. Onboarding and customer’s journey flow must be smooth and straightforward, without any unnecessary steps. The brand’s identity must shine through the visual components, completing the experience.

Need an expert provider of FinTech app development services? Contact us for more detail on what we can offer – and let’s start building the future of FinTech together!

Read also: