The article was updated on August 23, 2023.

Have you ever thought of the amount of data you create every day? Every credit card transaction, every message you send, even every web page you open… It all sums up to a total of 2.5 quintillion bytes of data that the global population produces on a daily basis.

This opens endless opportunities for the most forward-thinking businesses across a number of domains to capitalize on that data, and the banking industry is no exception.

While digital banking is used by almost half of the world’s adult population, financial institutions have enough data at hand to rethink the way they operate, to become more efficient, more customer-centric, and, as a result, more profitable. The question is: how do you get the most out of your data to keep up with the competition?

In this article, we will talk about common use cases for big data in banking (with real-life examples).

To start with, let’s take a step back to see the bigger picture and talk about the role of big data in banking.

The importance of big data in banking: The main benefits for your business

The big data analytics industry is huge and there is no indication that its growth will slow in the foreseeable future. The projected revenue of over $308 billion in 2023 will likely double in the next six years, exceeding the mark of $655 billion by 2029.

It comes as no surprise that banking is one of the business domains that makes the highest investment in big data and BA technologies. Analysts have calculated that it is the segment of banking, financial services, and insurance, commonly known as BFSI, that accounts for the largest share (23%) of revenue in the big data analytics market, which is directly linked to the ever-growing customer base.

The benefits of big data in banking are pretty clear:

- Big data gives you a full view on your business: from customer behavior patterns to internal process efficiency and even broader market trends. This means you can make informed, data-driven decision and, subsequently, obtain business results.

- It allows you to optimize and streamline your internal processes with the help of machine learning and AI. As a result, you get a significant performance boost and reduced operating costs.

- Big data in banking and financial services is pivotal to improving the level of client satisfaction, as data has always been the primary resource for developing and offering personalized solutions to each client.

- Customer segmentation in banking using big data may be helpful for classifying clients based, for instance, on their financial activities. This can be a foundation for analyzing client behavior, launching more effective marketing campaigns, and finding the most efficient approach to different groups.

- Big data in banking can also be used for developing algorithmic trading systems that can make more efficient trading decisions faster and more consistently than human traders.

- Big data analytics in banking can be used to enhance your cybersecurity and reduce risks. By using intelligent algorithms, you can detect fraud and prevent potentially malicious actions.

Big data challenges in banking

On the other hand, there are certain roadblocks to big data implementation in banking. Namely, some of the major big data challenges in banking include the following:

Legacy systems struggle to keep up

The banking sector has always been relatively slow to innovate: 92 of the top 100 world leading banks still rely on IBM mainframes in their operations. No wonder fintech adoption is so high. Compared to the customer-centric and agile startups, traditional financial institutions stand no chance.

However, when it comes to big data, things get even worse: most legacy systems can’t cope with the growing workload. Trying to collect, store, and analyze the required amounts of data using an outdated infrastructure can put the stability of your entire system at risk.

As a result, organizations face the challenge of growing their processing capacities or completely re-building their systems to take up the challenge.

The bigger the data, the higher the risk

Secondly, where there’s data there’s risk (especially taking into account the legacy problem we’ve mentioned above). It is clear that banking providers need to make sure the user data they accumulate and process remains safe at all times.

Yet, only 38% of organizations worldwide are ready to handle the threat, according to ISACA International. That is why cybersecurity remains one of the most burning issues in banking.

Plus, data security regulations are getting stringent. The introduction of GDPR has placed certain restrictions on businesses worldwide that want to collect and apply users’ data. This should also be taken into account.

Big data is getting too big

With so many different kinds of data and its total volume, it’s no surprise that businesses struggle to cope with it. This becomes even more obvious when trying to separate the valuable data from the useless.

While the share of potentially useful data is growing, there is still too much irrelevant data to sort out. This means that businesses need to prepare themselves and bolster their methods for analyzing even more data, and, if possible, find a new application for the data that has been considered irrelevant.

Despite the mentioned challenges, the advantages of big data in banking easily justify any risks. The insights it gives you, the resources it frees up, the money it saves – data is a universal fuel that can propel your business to the top.

The question is how to use big data in banking to its full potential.

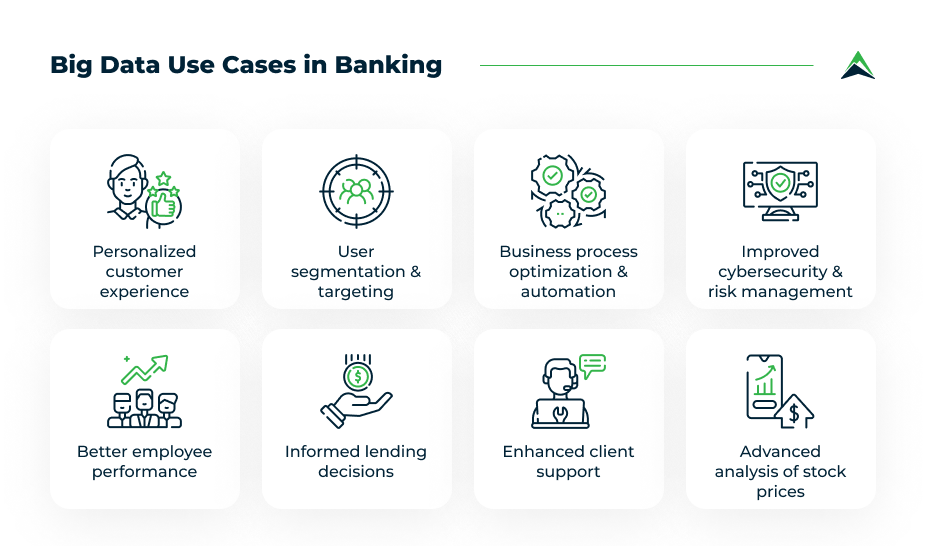

8 big data use cases in banking

Data is known to be one of the most valuable assets a business can have. Yet, it’s not the data itself that matters. It’s what you do with it.

To spark your creativity, here are some examples of big data applications in banking.

! See this one pager to understand your journey to becoming a data-driven company.

1. Personalized customer experience

According to Oracle, 84% of the surveyed executives agree that customers are looking for a more individualized, tailored experience. The report also states that the ability to offer users what they need can bring you up to an 18% higher annual revenue.

Just like other businesses across a number of domains, banks use big data to get to know their users and, as a result, find new ways to cater to them, connect in a more meaningful way, and deliver more value.

Your data can give you valuable insights into user behavior and help you optimize your customer experience accordingly. For example, by having a complete customer profile and exhaustive data on product engagement at hand, you can predict and prevent churn.

This approach is reportedly used at American Express. The company’s Australian branch relies on sophisticated predictive models to forecast and prevent customer churn.

By analyzing the data about previous transactions (as well as 115 other variables), they can identify accounts that are most likely to close within the next couple of months. As a result, the organization can take preventive actions and keep their customers from churning.

Read more about financial organizations using big data and AI to improve customer experience here.

2. User segmentation and targeting

McKinsey finds that using data to make better decisions can save up to 15-20% of your marketing budget. Taking into account that banks spend on average 8% of their overall budgets on marketing, tapping into big data sounds like a great opportunity to not only save, but generate additional revenue through highly targeted marketing strategies.

By using big data, you can better understand your customers’ needs, pinpoint problems in your product targeting and find the best way to fix existing problems.

For example, Barclays has been using the so-called “social listening”, i.e. sentiment analysis, to source actionable insights from user activity on social networks.

When the company launched its mobile app, many people were unhappy with the fact that users under 18 were unable to transfer or receive money. The dissatisfied customers reacted by voicing their disappointment on social media.

As soon as the data collected by Barclays revealed the problem, the company was able to fix the issue by allowing users aged 16+ to access the app’s full capabilities.

3. Business process optimization and automation

Further research from McKinsey reveals that around 30% of all work in banks can be automated through technology, and the key to this lies in big data.

As a result of advanced automation, banks can experience significant cost savings and reduce the risk of failure by eliminating the human factor from some critical processes.

JP Morgan Chase & Co. is one of the automation pioneers in the banking services industry. The company currently employs several artificial intelligence and machine learning programs to optimize some of their processes, including algorithmic trading and commercial-loan agreements interpretation.

One of its programs, called LOXM, relies on historical data drawn from billions of transactions enabling them to trade equities “at maximum speed and at optimal prices”, reports Business Insider. The process has proven to be far more efficient than both manual and the automated trading used earlier, and resulted in significant savings for the company.

Another data-based automation initiative from JP Morgan Chase is known as COIN. The machine learning algorithm, powered by the company’s private cloud network, is used to reduce the time needed to review documents: this task which previously required about 360,000 hours of work, now takes just a few seconds to complete.

The program also significantly decreased the human error associated with loan-servicing.

4. Improved cybersecurity and risk management

On top of optimizing its internal processes, as mentioned above, JP Morgan Chase relies on big data and AI to identify fraud and prevent terrorist activities among its own employees. The bank processes vast amounts of data to identify individual behavior patterns and reveal potential risks.

Another leading financial service provider, CitiBank, is also betting big on big data technologies. The company is investing in promising startups and is establishing partnerships with tech companies as a part of its initiative called Citi Ventures. Cybersecurity is one of the major spheres of interest the company has been exploring recently.

As a part of this strategic move, CitiBank invested in Feedzai, a data science company that uses real-time machine learning and predictive modeling to analyze big data to pinpoint fraudulent behavior and minimize financial risk for online banking providers.

As a result, CitiBank can spot any suspicious transactions, e.g. incorrect or unusual charges, and promptly notify users about them. Apart from being useful for consumers, the service also helps payment providers and retailers monitor all financial activity and identify threats related to their business.

5. Better employee performance and management

Big data solutions in banking allow companies to collect, make sense of and share branch (as well as individual employee) performance metrics across departments in real time. This means better visibility into the day-to-day operations and an elevated ability to proactively solve any issues.

A global banking provider, BNP Paribas, collects and analyzes data on its branch productivity to identify and swiftly fix existing problems in real time.

Using the company’s data analytics software, branch managers, as well as chief executives, can get a birds-eye-view on the branch’s performance based on a number of metrics, i.e. customer acquisition and retention, employee efficiency and turnover, etc.

6. Informed lending decisions

Credit risk assessment is one of the main challenges for banks and is often troublesome for their clients. Traditionally, banks cooperate with other financial institutions that store and analyze the credit history of a certain client and estimate whether he or she is able to pay off a debt.

However, nowadays, banks gain access to all information that is in any way related to creditworthiness. From particular transactions to overall spending habits, big data in banking and finance can evaluate client finance behavior and make lending decisions independently.

Kreditech has taken a step further and looks at the bigger picture of client reputation. They use such sources as Amazon and eBay, or social media, for instance, Facebook, to better understand the financial behavior and personalities of potential loaners.

The idea behind this approach is that the creditworthiness of a person can’t be measured accurately with traditional evaluation methods. On the contrary, the company strives to use any available sources to determine the situation at a given moment.

7. Enhanced client support

Customer support has always been a huge part of overall satisfaction with the services provided. The ability to communicate with the bank directly and without any obstacles is among the main demands of people who use banking services.

However, with the growing client base, the capacity for individual assistance to each client has proven itself to be limited when it comes to conventional approaches and human-only service. Luckily, banking institutions have a chance to use the data they get access to with the purpose of offering more prompt and precise predictions and solutions.

Artificial intelligence comes as an example of big data implementation in banking, as this technology functions based on big data, enhanced by machine learning and predictive analysis. Bank of America and its AI-powered virtual assistant Erica can not only resolve clients’ queries and remind them about important dates and operations but also, for instance, help them improve spending habits.

8. Advanced analysis of stock prices

In order to analyze potential target businesses for investment, it’s important for investors to estimate intangible assets, which have gained increasingly more importance in recent decades. However, classical approaches focus more on definite metrics and the overall background of a company.

Big data in investment banking gives an opportunity to gain insight into every area of a corporation’s activity, including its social reputation, environmental impact, human capital, innovation, and other things that can have an influence on stock prices.

That is exactly what Deutsche Bank pays its attention to. Its tool is called “a-DIG” and is used on the dbDIG (Data Innovation Group) platform. It looks through available information regarding the company in question to analyze its behavior and reinforce informed investment approaches.

The future of big data in banking looks bright: Make sure to keep up

As you can see, there are many examples of how big data is used in banking. Yet, all those attempts have barely scratched the surface. The maximum potential of big data in banking is still to be harnessed.

Big data becomes increasingly crucial in any area of the banking industry. Implementing big data in banking and finance is arguably the only way to regain control over the client flow while maintaining an excellent level of service delivery, which was showcased in multiple aspects.

Banks need to rethink their operations and adopt data-driven approaches if they want to stay relevant and competitive. Plus, big data in the banking sector can help you improve and grow your business.

If you are looking to explore this opportunity but are struggling to find appropriate big data applications in the banking sector for your business, we at Eastern Peak can help you out.

Our team has vast experience implementing fintech products of different complexities as well as building big data solutions from scratch. Among other projects, we helped Western Union implement an advanced data mining solution to collect, normalize, visualize, and analyze various financial data on a daily basis.

So, if you want to discuss opportunities and big data implementation options in banking, request for a personal consultation using our contact form.

Read also: