It is difficult for traditional banks to move forward quickly enough to meet the changing needs of contemporaneous customers. Because of this, external banking initiatives and corporate entities are now taking a leading role in this sector.

This paper discusses the major customer trends the banking industry is facing nowadays as well as different strategies embraced by them in order to mitigate risk and meet these challenges.

The banking social revolution

Banks are perhaps some of the worst adapters to change. A common misconception is that customers’ money is held tightly by serious, old-fashioned, straight-faced, conservative bankers who have no sense of humor and held straight A’s in all their math exams.

This is one of the reasons why the banking system in Switzerland had been so successful, as it was perceived to be a perfect fit given the efficient and dry culture of the Swiss people. But this perception was shattered into pieces. As of lately, many of these prominent Swiss banks have gone out of business due to their overly adventurous investments in financially engineered derivatives without having had established any proper safety net.

But like all organizations, banks have had to change with the times. The social media revolution, which caught the banks by surprise, has put a lot of pressure on banks to comply with new models of customer interaction. It was not so long ago that a bank’s primary customer interaction was through physical branches.

But this clearly is not a valid option for Generation Y and Z. Everything that the bank provides must be immediately accessible via any device anywhere, 24/7.

Updated customer trends

Up-to-date banking strategists are focusing on the following three trends in customer interaction:

- Shifting away from the branch: 45% of bank customers visit their local branch fewer than five times per year.

- Finding new avenues to connect: an annual growth of 31% of financial customers visit leading social networking sites.

- They are already on it: 92% of the 18 to 29 year-old demographic use social media.

*Source: Deloitte Research, 2019

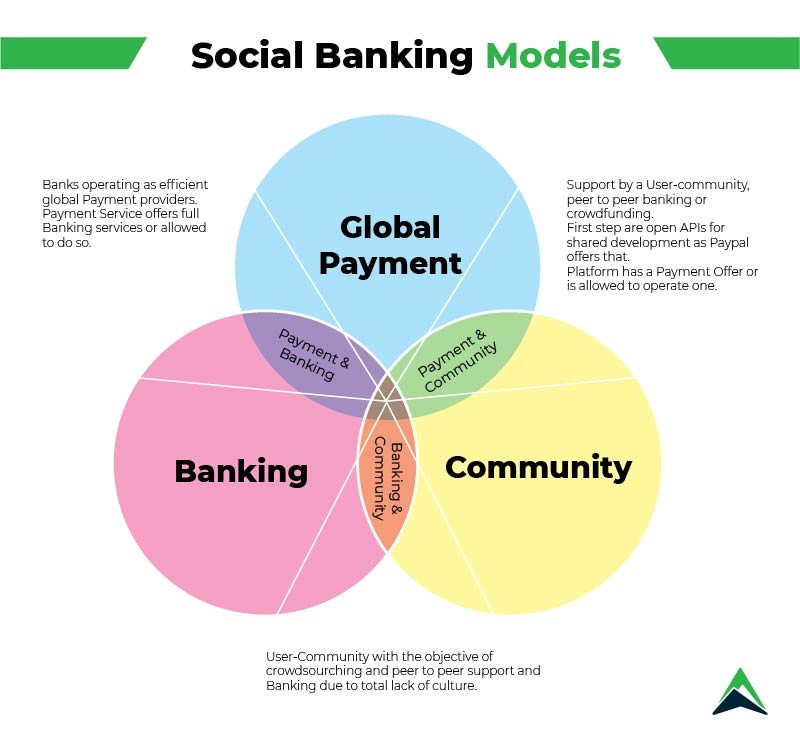

New social banking models

The investigation of these aforementioned social trends has led to the emergence of new social models:

- Crowdsourcing – establishing financial products or services by asking the user-community to contribute; this is characterized by peer-to-peer support, experience sharing and cooperation.

- Crowdfunding – funding projects by appealing to a large number of people to contribute small amounts of money via third-party platforms such as Startnext.

- User co-designed products and user-driven prices – for example, a product suggestion within a digital community such as an interest rate that is directly connected to the amount of ‘Likes’ on the bank´s Facebook profile.

- Peer-to-peer lending within a payment account.

- A global payment offer that allows account-to-account payments or account-to-cash-pick-up payments, etc.

A brave new banking world

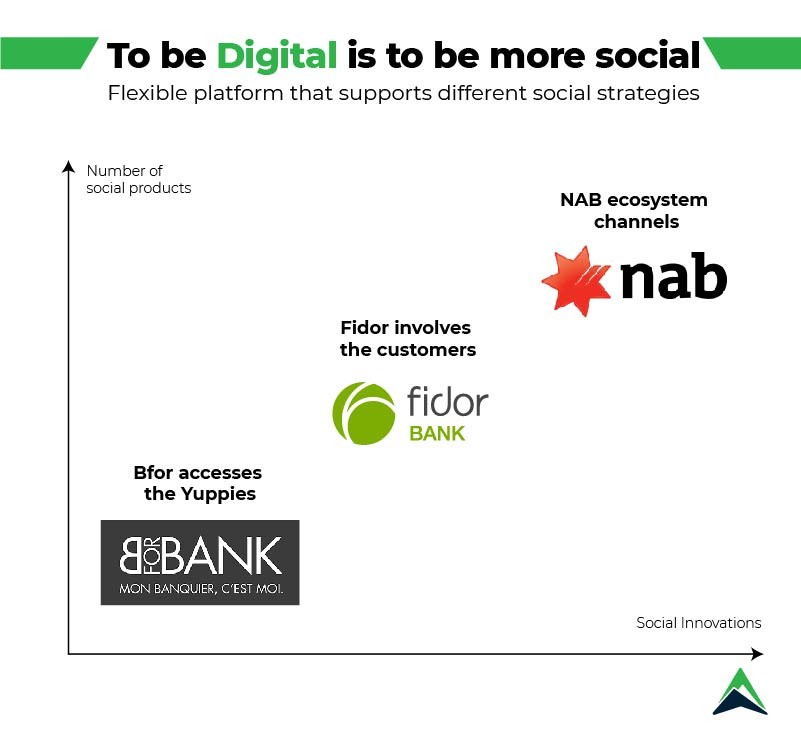

By now, nobody is in doubt that a brave new banking world has emerged. With expertise in high risk reduction, traditional banks are typically implementing some key entry strategies as they step into the social market:

- Establish a totally separate branded bank, addressing a specific customer segment, and, not necessarily low-end customers. Bfor-bank is part of the Credit Agricole Group in France and targets professionals who want to manage their investments themselves, offering them a better SLA for current accounts and securities.

- Invest in a pure social banking platform. A good example is Fidor Bank. Several traditional banks have invested in this digital bank, and it serves as their social innovation arm.

- Encourage internal growth by changing the DNA of the bank to be more social. NAB in Australia, for example, has become a service hub for financial ecosystem partners.

Eastern Peak’s effective landscape

Eastern Peak identified these trends some time ago have been enabling banks to effectively respond to these trends while defining a business growth landscape. The landscape comprises of three main domains that each bank should consider when establishing a near-future strategy:

- A global payment gateway supporting a variety of traditional and non-traditional payment methods.

- Core banking support, mainly for current accounts, deposits, loans and securities.

- The digital community should enable traditional banks to become more socially aware, and facilitate the deployment of new social models.

To be digital is to be more social

Far from being a passing trend, digital banks are firmly here to stay!

Eastern Peak is currently working with one of the largest banks in Israel, developing a crowdfunding social banking model to increase share-of-wallet and obtain new transaction streams. While this activity is not intended to provide an immediate source of new income for the bank, it will position the organization as an innovator and contribute to its overall digital campaign.

There are opportunities to be realized in the digital banking domain. Lending Club is the world’s largest online credit marketplace, providing customer loans and financing through a fast, easy online or mobile interface. With a market valuation of $9 billion, Lending Club is now the 14th-largest bank in America, considerably larger than City National, Zions, and Comerica.

Read also: